Today I’m going to be showing you why NOW is the best time to buy a designer handbag, and which ones to invest in.

This is going to be a little different than my usual capsule wardrobe content, so bear with me though just a little bit of economics and math. I promise it will be worth it! There’s a designer handbag at the end of this tunnel.

Inflation

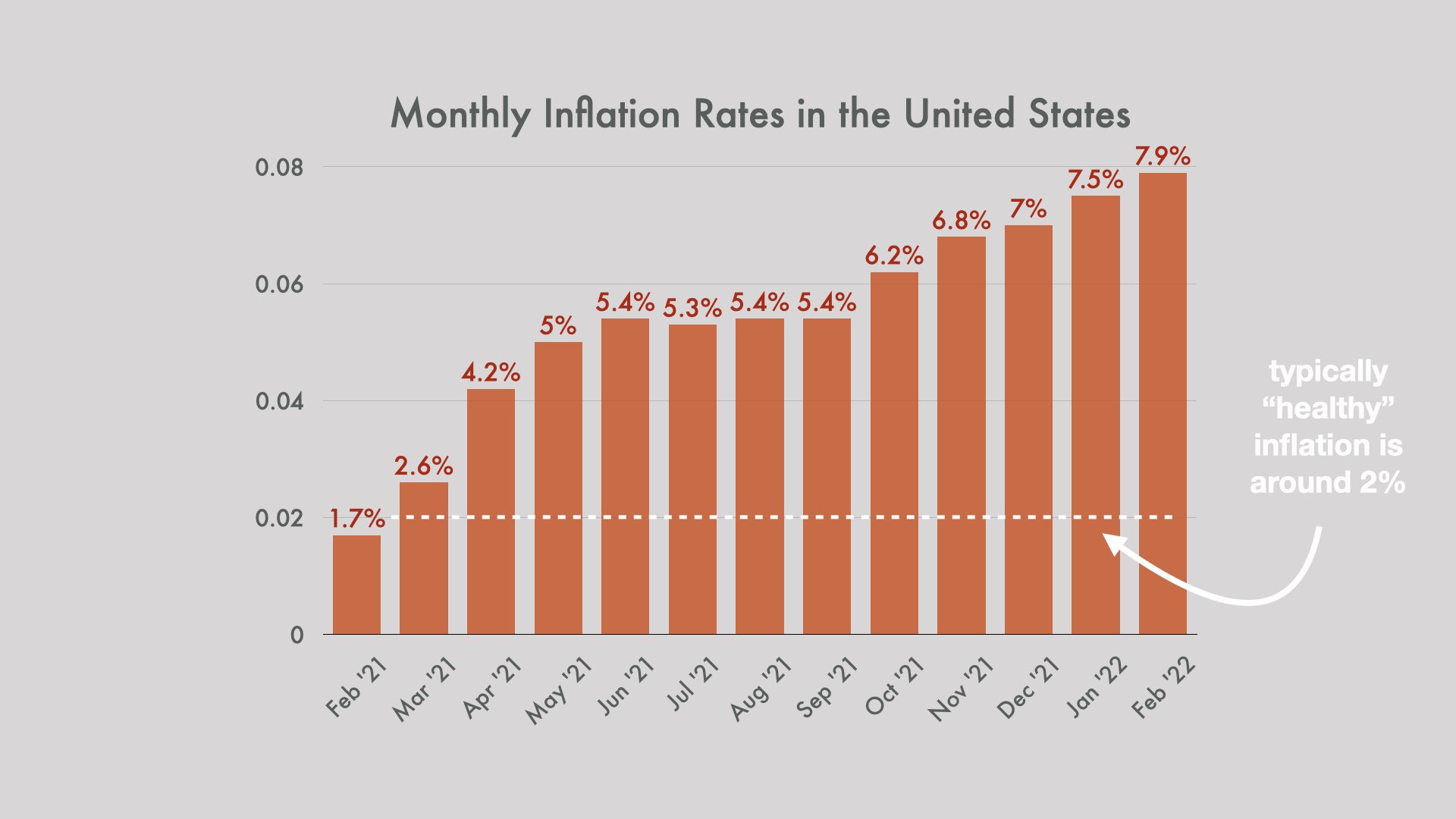

As you may know, inflation has been through the roof for the past year and is predicted to continue to increase AND to remain high throughout at least the rest of 2022 and likely longer. Average inflation rate in 2021 was 4.7% and has averaged 7.7% so far in 2022 and is currently at 7.9% with an upward trend. According to Kiplinger, the surge in gasoline prices this month will push inflation to near 10% and the inflation rate will remain high through the rest of the year, ending at 6.5% or so in December.

So, what does this mean for all of us? It means that our cash savings have been decreasing in value since the beginning of 2021, a trend which is predicted to continue. But, I have some good news. That designer handbag you’ve been eyeing could be part of your answer to this problem.

Investment Alternatives

You might be wondering how a designer handbag could be a good investment. Well, let’s talk about some of your investment alternatives.

First, the stock market. Goldman Sachs is only predicting a 2.1% increase in the S&P 500 in 2022 from its open on January 3, 2022. With inflation set to outpace overall stock market gains for at least the next year unless you’re lucky enough to beat the market, investments in the stock market are only marginally better than cash right now.

The next most popular investment would be US Treasury Bonds. According to Bloomberg, 5-year bond yields are still only around 2.1% as well with 30-year bond yields not much better at 2.4%.

And high-yield savings accounts are only offering around 0.6% interest these days!

While real estate would be a good investment option expected to keep up with inflation, a huge down payment and mortgage is required as well as recurring utility and maintenance costs.

These options all sound pretty bad, right? What if I told you that the right designer handbag could maintain its value through inflation and actually help you save more money in today’s economic environment?

The Best Investment Bags

So, before we get into the math, let’s talk about which designer handbags make the best investments.

A great resource for discovering which brands and styles are currently holding their resale value is the Comprehensive Luxury Appraisal Index for Resale Report, otherwise known as CLAIR. This yearly report is released by the luxury bag resale store Rebag.

According to CLAIR, the best brands for resale are Hermès (The Unicorn), Chanel, Louis Vuitton, Saint Laurent, Gucci, and Christian Dior.

It is well known throughout the industry that Chanel, Louis Vuitton, and Hermès historically have the best resale value in the handbag market, with certain styles even beating the stock market in appreciation. Let’s take a deeper look at these three brands to see which particular styles make the best investments.

01 // Hermès

There’s a reason why the CLAIR report calls Hermès “The Unicorn.” Hermès bags are extremely hard to acquire and most will retain or increase in value. The Hermès Birkin bag retails anywhere from $9000 to $150,000 and can see resale prices in the hundreds of thousands of dollars.

SHOP HERMÈS // The Birkin

The Hermès Kelly also retains or increases in value, and certain styles in both of these bags have historically outperformed the S&P 500.

SHOP HERMÈS // The Kelly

02 // Chanel

Another handbag that has outperformed the stock market is the Chanel Medium Classic Flap in Caviar Leather. A representative from LePrix noted that her version of this bag increased in price by 206% over a ten year period while the S&P 500 return was 49% over that same period.

SHOP CHANEL // The Classic Flap

Another Chanel bag worth considering is the Chanel Boy Bag. While the Chanel Boy Bag retains about 80-90% of its value, adjusted for inflation, it has joined the ranks of the Classic Flap and has maintained popularity since it was introduced in 2011. In today’s inflationary environment, even a bag that retains only 80% of its value is a better investment than cash.

SHOP CHANEL // The Boy Bag

According to Rebag’s CLAIR report, the 19 Flap Bag, which was designed in 2019 to commemorate the death of Karl Lagerfeld, is currently reselling for 110% of its value.

SHOP CHANEL // The 19 Flap Bag

03 // Louis Vuitton

Finally we have the Louis Vuitton Neverfull tote bag which is reported to retain 85-120% of its value with limited edition bags seeing upwards of double the resale value. According to CLAIR, the Neverfull along with four other Louis Vuitton bags hold an average of 125% of their value on the resale market.

SHOP LOUIS VUITTON // The Neverfull

Let’s Do the Math

So, now that we know how to find the projected resale value for designer handbags, let’s finally do a little bit of math to show why NOW is the best time to buy a designer handbag.

Say you have $8000 in cash right now that isn’t allocated to an emergency fund or retirement fund. Assuming that the average inflation rate over the next three years is 5%, we can calculate the Future Value of that cash after three years using the Future Value equation. After three years with inflation at 5%, that $8000 will only have the purchasing power of $6859 in today’s dollars. Not so good, huh?

The Future Value of Cash

Present Value x ( 1 - Inflation Rate ) ^ ( # Years ) = Future Value

$8000 x ( 1 - 0.05 ) ^ 3 = $6859

However, if you were to purchase the Chanel Classic Flap for $8000 today, which retains 97% of its value adjusted for inflation, that bag would be worth $7760 in today’s dollars after three years. That means that the Chanel Classic Flap retains 13% more value than cash over that three year period. PLUS you get that bag that you’ve always wanted.

The Future Value of the Chanel Classic Flap

Present Value x ( Value Retention after Inflation ) = Future Value

$8000 x 0.97 = $7760

I really hope you enjoyed this topic and I hope it inspires you to think a little bit more about your financial future and how you can be financially savvy while also investing in things that you will love and appreciate for years to come.

The information presented in this article does not constitute professional financial advice. All investment strategies involve risk of loss. If you have any doubts as to the merits of an investment, seek advice from an independent financial advisor.

FINALLY get your body type!